In your balance sheet – the balance of your accruals account would have been:Īs you have now received an invoice, your accruals account will have a nil balance, but you will have a creditor or accounts payable balance of £186 (£155 + VAT) until the invoice is paid.

Accrued expenses example journal entries plus#

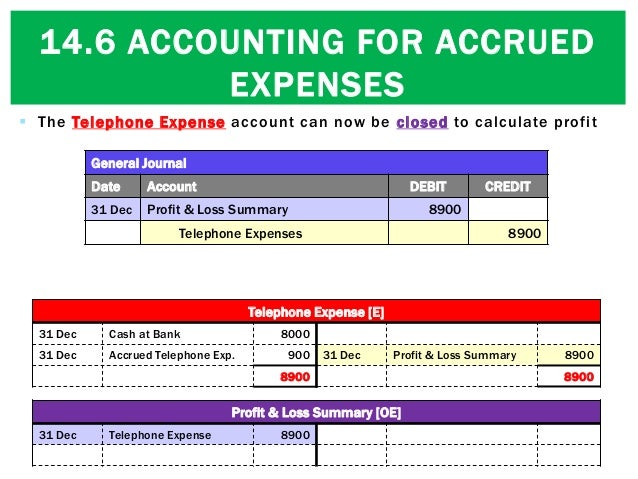

Say we receive our quarterly invoice for telephone costs in March of £155 plus VAT. 28-Feb- xx Being an accrual of £50 for monthly telephone costs billed quarterly We will create another journal entry for our February accrual. Say we want to accrue another £50 of telephone costs in February as we have not received the quarterly invoice yet. 31-Jan- xx Being an accrual of £50 for monthly telephone costs billed quarterly We will create a journal entry for our accrual. Say we want to accrue £50 of telephone costs in January. Lets look at the accounting entries: January -xx This ensures that we spread the quarterly bill over the individual months in each quarter. When the invoice is received at some point in the future, the accrual is reversed to offset the invoice received, with the costs already accrued. We want the cost to appear in our accounts as we have incurred the liability and we know we will have to pay the supplier – but we have not got the invoice yet.Īn accrual represents a current liability in the balance sheet and a cost to the profit and loss account.įor example telephone costs may be invoiced on a quarterly basis, so a monthly accrual is charged or debited to the profit and loss account and credited to the balance sheet accruals account. In accounts – this is called the matching principle.Īn accrual is a provision for a cost that we have not yet been billed for. Income and expenditure should be matched with one another where possible, and reflected in the profit and loss account for the period. The credit only makes sense when coupled with the subsequent debit on January 15.It has been a long-accepted accounting principle that revenue and costs should be recognised as they are earned or accrued, rather than when their cash value is received or paid. It may seem odd to credit an expense account on January 1, because, by itself, it makes no sense. The net impact with reversing entries still records the correct amount of salary expense for 20X4 ($2,000 credit and $5,000 debit, produces the correct $3,000 net debit to Salaries Expense). On the following payday, January 15, 20X5, the entire payment of $5,000 is recorded as expense. However, the first journal entry of 20X4 simply reverses the adjusting entry. The adjusting entry in 20X3 to record $2,000 of accrued salaries is the same. The next example revisits the same facts using reversing entries.

The entry on that date required a debit to Salaries Payable (for the $2,000 accrued at the end of 20X3) and Salaries Expense (for $3,000 earned by employees during 20X4). The next payday occurred on January 15, 20X4, when $5,000 was paid to employees. An adjusting entry was made to record $2,000 of accrued salaries at the end of 20X3. The first example does not utilize reversing entries. Consider the following alternative sets of entries. A reversing entry is a journal entry to “undo” an adjusting entry. Reversing entries are optional accounting procedures which may sometimes prove useful in simplifying record keeping. Chapter 24: Analytics for Managerial Decision Making.Chapter 23: Reporting to Support Managerial Decisions.Chapter 22: Tools for Enterprise Performance Evaluation.Chapter 21: Budgeting – Planning for Success.Chapter 20: Process Costing and Activity-Based Costing.Chapter 19: Job Costing and Modern Cost Management Systems.Chapter 18: Cost-Volume-Profit and Business Scalability.Chapter 17: Introduction to Managerial Accounting.Chapter 16: Financial Analysis and the Statement of Cash Flows.Chapter 15: Financial Reporting and Concepts.Chapter 14: Corporate Equity Accounting.Chapter 12: Current Liabilities and Employer Obligations.

Chapter 11: Advanced PP&E Issues/Natural Resources/Intangibles.Chapter 10: Property, Plant, & Equipment.Chapter 6: Cash and Highly-Liquid Investments.Chapter 5: Special Issues for Merchants.Chapter 1: Welcome to the World of Accounting.

0 kommentar(er)

0 kommentar(er)